Outline

- Introduction

- Brief overview of Reddit as a social media platform

- Transition to Reddit’s financial aspects and stock price interest

- Reddit’s Journey to IPO

- History and growth of Reddit

- Announcement of Reddit going public

- Initial public offering (IPO) details

- Stock Performance Post-IPO

- Initial stock performance

- Market reactions and volatility

- Comparison with other social media stocks

- Factors Influencing Reddit Stock Price

- User growth and engagement

- Revenue streams (advertising, premium subscriptions)

- Competition and market trends

- Investor Sentiment and Analyst Opinions

- Analyst ratings and target prices

- Investor sentiment on Reddit’s future

- Key financial metrics and performance indicators

- Conclusion

- Summary of Reddit’s stock performance and future outlook

- Final thoughts on investment potential

- FAQs

Reddit’s Journey to IPO

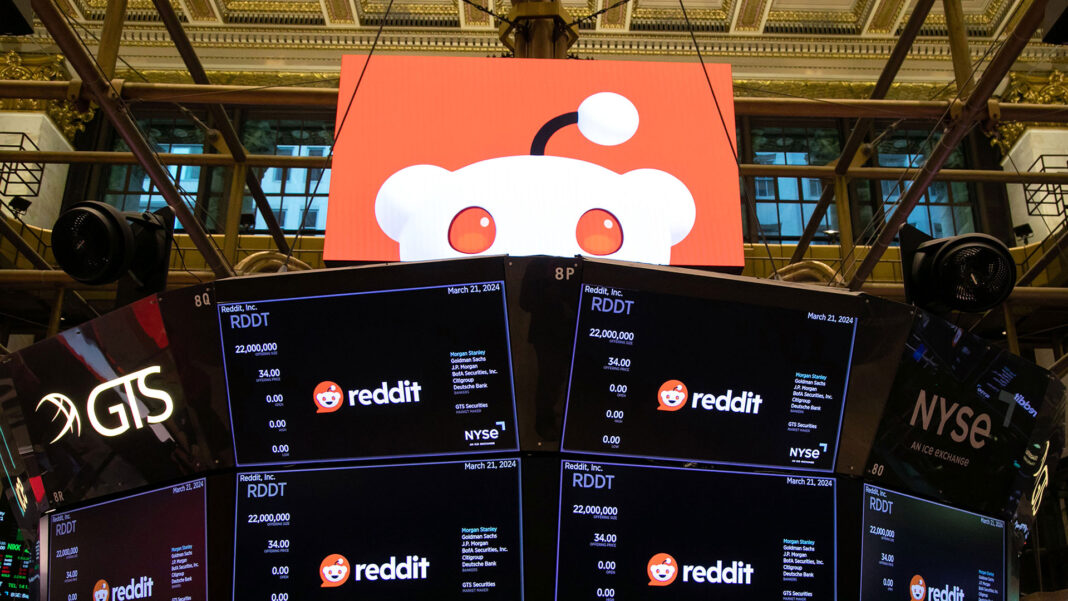

Reddit, the popular social media platform known for its diverse communities and discussion forums, announced its plans to go public, capturing the attention of both users and investors. Founded in 2005, Reddit stock price has grown significantly, boasting millions of active users in the social media landscape. The platform’s decision to go public was seen as a natural progression given its increasing influence and revenue potential. Reddit filed confidentially for an initial public offering (IPO) in December 2021, with reports suggesting a valuation that could exceed $15 billion. This move was highly anticipated as it marked a significant milestone in Reddit’s journey from a niche online community hub to a major player in the digital advertising space.

Stock Performance Post-IPO

Since its IPO, Reddit’s stock performance has been a topic of interest and speculation. The initial days saw substantial volatility, a common occurrence for newly listed tech companies. Market reactions were mixed, with some investors optimistic about Reddit’s growth potential and others cautious due to the competitive nature of the social media market. Comparisons were frequently drawn to other social media giants like Facebook, Twitter, and Snapchat, analyzing how Reddit’s unique community-driven model might fare in the stock market. Despite the fluctuations, Reddit stock price has shown resilience, underpinned by its robust user base and innovative revenue strategies, including advertising and premium memberships. Analysts continue to closely monitor Reddit’s performance, considering factors such as user engagement metrics and revenue growth in their evaluations.

Conclusion

Reddit’s journey to becoming a publicly traded company marks a significant chapter in its history, reflecting its evolution and increasing importance in the social media landscape. While the stock has experienced volatility, its performance is closely watched by analysts and investors alike, with many seeing long-term potential in its unique community-driven model and diversified revenue streams. As Reddit stock price continues to innovate and grow, its stock price will likely reflect the platform’s ability to navigate market challenges and capitalize on new opportunities. For potential investors, understanding Reddit’s market position, user engagement, and financial health is crucial in making informed investment decisions.

FAQs

1. When did Reddit go public? Reddit filed confidentially for an IPO in December 2021, though the exact date of going public can vary based on regulatory processes and market conditions.

2. What was Reddit’s valuation during its IPO? Reports suggested that Reddit’s valuation during its IPO could exceed $15 billion.

3. How has Reddit’s stock performed since its IPO? Reddit’s stock has shown significant volatility since its IPO, a common trend for newly listed tech companies. However, it has displayed resilience due to its strong user base and innovative revenue strategies.

4. What factors influence Reddit’s stock price? Key factors include user growth and engagement, revenue streams from advertising and premium subscriptions, competition, and overall market trends.

5. How do analysts view Reddit’s stock? Analysts have mixed opinions, with some optimistic about its growth potential and others cautious due to the competitive social media market. They closely monitor metrics like user engagement and revenue growth.

6. Is Reddit a good investment? As with any investment, potential investors should consider Reddit’s market position, financial health, and future growth prospects. Consulting with financial advisors and conducting thorough research is recommend.