Outline

- Introduction

- Brief overview of the Bloomberg Commodity Index (BCOM).

- Importance and role in the financial markets.

- Composition and Weighting

- Components of the index.

- Methodology of weighting and selection criteria.

- Performance and Trends

- Historical performance.

- Key factors affecting the index’s trends.

- Conclusion

- Summary of the significance of the BCOM.

- Future outlook for commodities based on the index.

- FAQs

- Common questions.

Introduction and Composition

The Bloomberg Commodity Index (BCOM) is a well-known benchmark for measuring the performance of commodities across various sectors, including energy, agriculture, precious metals, and industrial metals. Established to provide a broad-based representation of commodity markets, BCOM plays a critical role in the financial industry by offering investors insights into commodity price movements and inflation trends. The index comprises 23 exchange-traded futures on physical commodities, with its components selected based on their liquidity and economic significance. The methodology ensures diversity and minimizes the impact of any single commodity on the index’s overall performance.

Performance and Influencing Factors

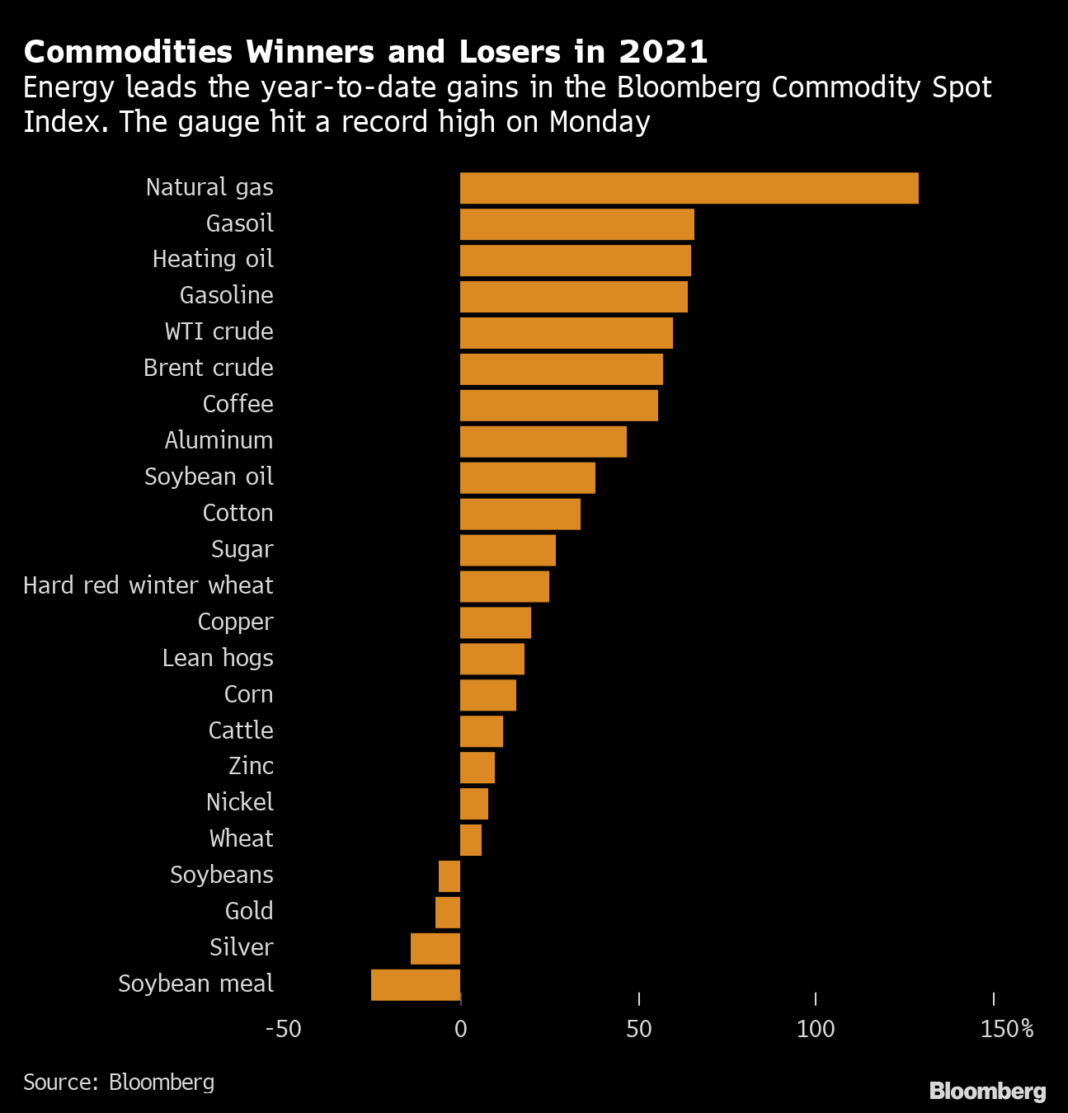

Over the years, the Bloomberg Commodity Index has experienced significant fluctuations influenced by various macroeconomic factors, including supply and demand dynamics, geopolitical events, and changes in currency values. For instance, energy commodities such as crude oil and natural gas often drive substantial movements in the index due to their sensitivity to geopolitical tensions and OPEC policies. Similarly, agricultural commodities are affected by seasonal patterns and climatic conditions. Historical data shows that BCOM can serve as an effective hedge against inflation, as commodities typically gain value during inflationary periods. By tracking the index, investors can gain insights into emerging trends and potential opportunities within the commodity markets.

Conclusion

The Bloomberg Commodity Index remains an essential tool for investors and analysts looking to understand commodity market trends and manage inflation risks. Its comprehensive and diversified approach provides a reliable benchmark for evaluating commodity investments. As global economic conditions evolve, the index will continue to reflect the dynamic nature of the commodity markets, offering valuable insights into future trends and opportunities. Understanding the components and factors influencing BCOM can help investors make informed decisions in a rapidly changing economic landscape.

FAQs

- What is the Bloomberg Commodity Index?

- BCOM is a benchmark that tracks the performance of a broad range of commodities across sectors such as energy, agriculture, and metals.

- How are the components of BCOM selected?

- Components are selected based on liquidity, production, and economic significance, ensuring a diverse representation of the global commodity markets.

- Why is the Bloomberg Commodity Index important for investors?

- BCOM provides insights into commodity price trends, helps in managing inflation risks, and serves as a tool for diversifying investment portfolios.

- How does the index respond to inflation?

- Commodities in the index often gain value during inflationary periods, making BCOM an effective hedge against inflation.

- Where can I access Bloomberg Commodity Index data?

- BCOM data is available through financial platforms such as Bloomberg Terminal and various financial news websites.